Consumers worry about privacy but still willing to share data

Aimia survey: Shoppers more willing to share personal information in

exchange for rewards

MONTREAL, Nov. 3, 2014 /CNW Telbec/ – Despite a series of recent,

high-profile data breaches and consumer concerns over data collection,

shoppers are still open to sharing their personal information, reveals

a new survey released today by Aimia Inc. (TSX: AIM).

Just how much they’re willing to share, and to whom, varies greatly by

industry and nationality. According to the Aimia Loyalty Lens report,

when asked to rank types of businesses by the degree to which they are

comfortable with those businesses handling an individual’s personal

data, an overwhelming majority of consumers (82 per cent) put banks in

the top four (out of ten), along with supermarkets (64 per cent),

mobile phone providers (56 per cent) and their places of work (50 per

cent). Conversely, 65 per cent of consumers place online search engines

in the bottom two of institutions they trust and 58 per cent of

consumers place social networks in the bottom two.

Despite the perception that some industries are doing a better job at

protecting data than others, more than half of shoppers internationally

(55 per cent) are willing to share personal information with companies

in exchange for relevant rewards. That willingness is uneven across

international markets. Close to three-quarters (74 per cent) of

respondents from India are open to providing their personal details,

compared to only one-third of more skeptical Germans (39 per cent).

This may be because German consumers value their personal information

the most amongst the 10 markets surveyed (36 per cent versus 29 per

cent internationally).

“Consumers are increasingly required to trust companies to handle their

personal details,” said David Johnston, Group Chief Operating Officer,

Aimia Inc. “Transparency about how data is being collected and used

will become a key differentiator for businesses going forward. Those

that are clear and offer a better customer experience by how they use

that information will build greater trust and loyalty.”

Avoiding Creepiness

However, there is a fine line between providing a customized experience

and coming across as just plain creepy.

With the data that retailers now have, they can greet each customer by

name. But knowing the particularities of the local market matter. In

France, 47 per cent say they’re not comfortable when supermarket

cashiers address them by name, while in the Middle East 46 per cent see

it as perfectly fine. Meanwhile, 66 per cent of Canadians are put off

by supermarkets that send coupons to their mobile phones, while 52 per

cent of residents in India are quite comfortable with it. The same

applies when supermarkets follow up by phone or email after making a

purchase. More than half (57 per cent) of Americans see the follow-up

gesture as going too far, compared to only one in three (34 per cent)

of those in the Middle East.

Similar variances occur when it comes to the travel and leisure sector.

While over half of consumers in Australia (56 per cent) are comfortable

being called by their names by airlines, only 33 per cent of Italians

are comfortable with the gesture. When it comes to follow-up calls and

emails once a purchase has been made, 39 per cent of consumers

internationally appreciate the gesture by airlines, but in the UK, 38

per cent are uncomfortable with the practice.

“With today’s technological advances, companies have the ability to

truly understand consumers — from what we like to eat, to where we like

to shop, to even our names. But it’s important for businesses to know

when and where it’s appropriate to use this information to engage

consumers, and that it varies significantly by industry and

nationality. The companies that win will be the ones that listen to

their consumers’ preferences and use data accordingly to build mutually

beneficial relationships,” Johnston said.

Other highlights from the survey include:

-

The number one driver behind loyalty to supermarkets is being rewarded

for that loyalty (22 per cent) with price coming in second at 17 per

cent. In contrast, the top driver at banks is longevity of service,

with rewards coming only in fifth place. -

Not all rewards are created equal. For many institutions — including

supermarkets (36 per cent) and banks (50 per cent) — getting cash back

is king. But for airlines, 69 per cent prefer either loyalty currency

or exclusive discounts and for hotels it’s 57 per cent. -

New forms of information are now becoming as sacred as or more sacred

than personal data that have traditionally been kept private. When it

comes to the information consumers protect the most, web history and

income top the list with 39 per cent and 30 per cent respectively

stating they would never share such information. That’s compared with

29 per cent who would never share their mobile phone number and 23 per

cent who would never reveal their online purchases.

The Aimia Loyalty Lens report looked at trends around consumer loyalty

to industries, engagement with technology and attitudes towards data

privacy. Additional findings are available here: www.aimia.com/loyaltylens.

Research Methodology

The international Aimia Loyalty Lens survey was commissioned by Aimia

and fielded by Research Now between June and July 2014.

The study surveyed 24,335 respondents in 10 international markets:

United Kingdom, Spain, Italy, Germany, France, Canada, United States,

Australia, India, and the Middle East: In all markets, apart from the

Middle East and India, the sample sizes are all nationally

representative. Because of the online nature of the survey there is

some bias towards younger, higher income groups in the Middle East and

Indian markets.

About Aimia

Aimia Inc. (“Aimia”) is a global leader in loyalty management. Employing

more than 4,300 people in 20 countries worldwide, Aimia offers clients,

partners and members proven expertise in launching and managing

coalition loyalty programs, delivering proprietary loyalty services,

creating value through loyalty analytics and driving innovation in the

emerging digital, mobile and social communications spaces.

Aimia owns and operates Aeroplan, Canada’s premier coalition loyalty

program, Nectar, the United Kingdom’s largest coalition loyalty

program, Nectar Italia, Italy’s largest coalition loyalty program and

Smart Button, a leading provider of SaaS loyalty solutions. In

addition, Aimia owns stakes in Air Miles Middle East, Travel Club,

Spain’s largest coalition loyalty program, Club Premier, Mexico’s

leading coalition loyalty program, China Rewards, the first coalition

loyalty program in China that enables members to earn and redeem a

common currency, Think Big, the owner and operator of BIG – AirAsia

and Tune Group’s loyalty program, Brazil’s Prismah Fidelidade and i2c,

a joint venture with Sainsbury’s offering insight and data analytics

services in the UK to retailers and suppliers. Aimia also holds a

minority position in Cardlytics, a US-based private company operating

in card-linked marketing. Aimia is listed on the Toronto Stock

Exchange (TSX: AIM). For more information, visit us at www.aimia.com.

SOURCE AIMIA

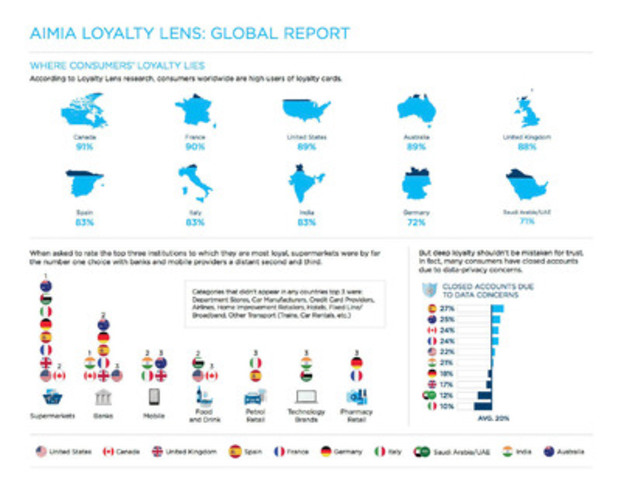

Image with caption: “With today’s technology, companies have the ability to understand and target consumers based on their personal information. But are consumers open to sharing their data? Is it driving a loyal customer experience? The Aimia Loyalty Lens explores international trends around consumer loyalty, engagement with technology and attitudes towards data privacy. (CNW Group/AIMIA)”. Image available at: http://photos.newswire.ca/images/download/20141103_C9292_PHOTO_EN_43156.jpg

Contact:

Media Contacts

Megan Ratcliffe

+44 207 152 4881

megan.ratcliffe@aimia.com

Krista Pawley

+1 416 737 8413

krista.pawley@aimia.com